Benefiting from the New Silk Road

Investing in BremenThe New Silk Road Network NSRN connects logistics experts from Europe and Asia

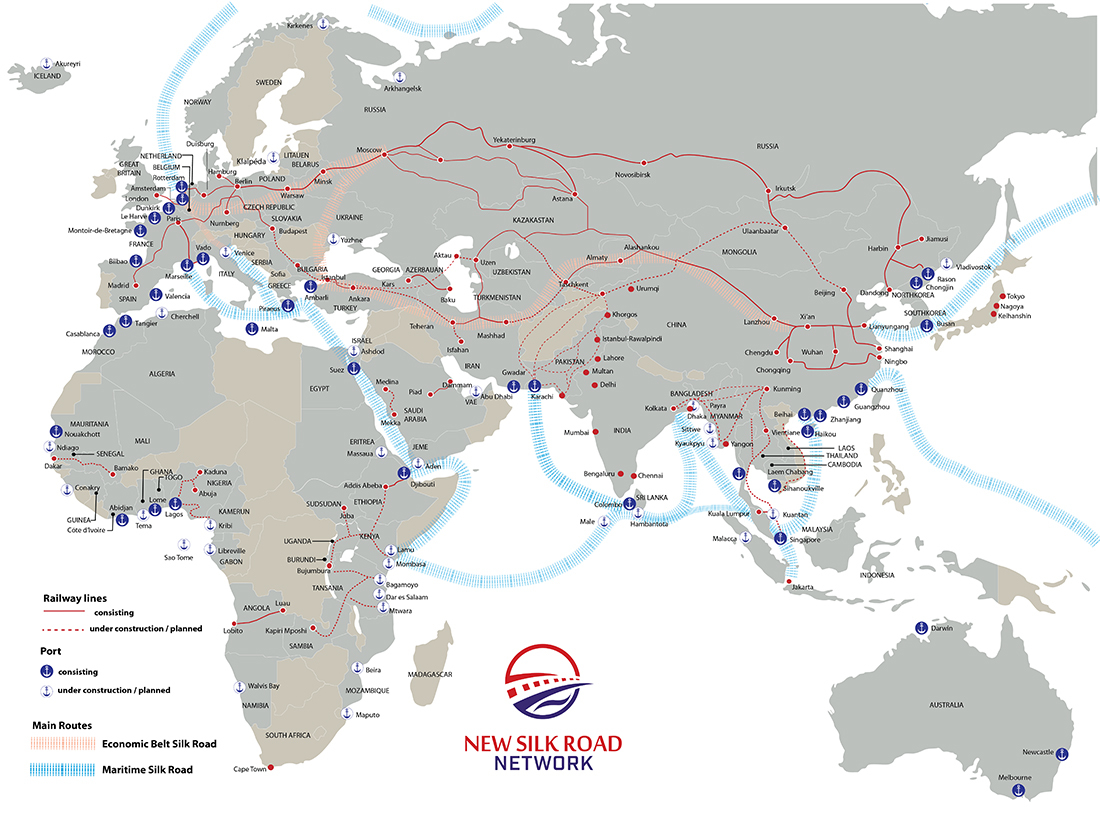

The new Silk Road is probably the largest infrastructure project of the millennium to date. With investments in hundreds of countries, China has been influencing international flows of goods since 2013, establishing global infrastructures and thus securing resources and influence.

One of the most important projects within the initiative is the reactivation of the old Silk Road, which was used in ancient times to trade between Asia and Europe, and today as a railway line for freight traffic. But many sea-based projects, such as investments in ports, are also part of it.

The New Silk Road Network (NSRN) was founded in Bremen in September 2019 with the aim of enabling companies to benefit from the Belt and Road Initiative (BRI). We talked to two of the founders, logistics expert Ziwei Liu and Alexander Hellmers, Head of Bremen-based Project Logistics Alliance.

Mr. Hellmers, what is the purpose of the network?

Hellmers: The BRI is Chinese driven – if you are a small European company that generates business mostly from its domestic customers, like a warehousing company, it is extremely difficult to get direct customers in China and therefore profit from the BRI. You don’t know who to talk to or how to get customers from China – you lack the local expertise and the market access. And you can’t physically be represented in China, because it is not feasible to operate your own office.

For these small and medium companies we are highly interesting. We have the ability to identify the important parts of the logistics chain. Not just in China, but say in Kazakhstan, Russia, Middle East, Poland. We provide the connections to the local train operators, warehouses, truckers, forwarders, operators, terminals, customs agencies etc.

Companies in our network can decide to who they want to talk to, if they want to expand their business and use the infrastructure of the BRI for their logistics chain. The focus of our network is not to collect as many people as possible, it is to create transparency and coverage along the BRI.

So what companies are you looking for?

Liu: We look for people with experience and knowledge in their own market and an interest in engaging with China, so supply chains can get cheaper and more efficient. Often times in logistics, when building international supply chains, you have to rely upon many contractors and subcontractors. That is driving up the costs which makes it unfeasible for clients. But now there are many new hubs emerging along the new Silk Road, and we want to have a specialist in every one of those countries. We are searching for niche players, for local heroes, because they have great expertise in their area – but usually have a lack of international exposure. Our aim is to have every company listed with what they are best at.

So if you need to ship something to rural Mongolia, you can pick your supply chain yourself and don’t have to rely on contractors and subcontractors.

So right now, there is a huge inefficiency in the supply chain?

Hellmers: Yes, the Chinese government is subsidizing the expansion right now, but is tightening the budgets. There is an increase in demand for efficiency in the future, when the subsidies are dwindling. And that is where we come into play, mapping and connecting warehouses, forwarders, truckers and all these players and bringing them together and eliminating the need for chains of subcontractors, which are needed now because knowledge and communication are missing.

Our network will be faster and more efficient since everyone can talk directly to the local hero who knows his market.

-Alexander Hellmers

Are the big players in the Market – say DHL, Costco, CMA, Kühne+Nagel – competition for small companies expanding on the BRI, as they already have huge infrastructures and more efficient supply chains?

Liu: If you look at the market as a whole, the majority of the cargo is not controlled by the big companies – but the majority are small and medium sized companies of up to a few hundred people. They don’t have the international exposure, global branding or network to leverage the benefits from the BRI, which is a great pity because there is so much potential. We want to give them the ability to run the same level of services big companies can offer around the world.

Hellmers: Big companies have their own offices in China and operate in the big cities, like Shanghai, Beijing or Shenzhen. But if you are asking for services in smaller cities, they will also work with local subcontractors – so they have no additional advantage. Our network will be faster and more efficient since everyone can talk directly to the local hero who knows his market.

You focus on railroads and the land route right now?

Liu: We are focussing on railroads in the beginning because they are new and many companies need help exploring the opportunities, but we also keep the sea routes in mind. In general, it is a strong focus on Eurasia and some focus also on Africa, as Chinese investments are very heavy there. We have companies from Germany, Middle East, Turkey, Poland, Bangladesh, China and Russia already.

What is the main benefit of sending goods via train to China?

Liu: The train positions itself between plane and ship. Ship is unbelievably cheap and plane far more expensive. Shipping a 40-foot-container between Germany and central China costs about 2,000 to 2,500 Euros right now. When looking at transit time, air is 1-2 days, train 13-18 days, ship 30-40 days. So it’s about the kind of freight you are shipping. If it is perishable, of high value, or has to be there in a short time, but a plane is too expensive, the railroad is a great alternative.

Will there be an increase in train freight in the upcoming years?

Hellmers: Interesting question. The number is set to double each year, which is incredible. Shipping rates are expected to rise next year, but not to an amount where train freight will be competitive. The train is competitive if time is a factor or goods are heading towards inland China. Train subsidies are due to decrease, but there is an increase in demand, so this could actually be good as the market will be more regulated, and maybe there will be more need for ‘less than container load’ or LCL freight as opposed to block trains, which is beneficial for SME’s. I forecast a stable price for train freight rates and that sea shipping rates will go up. And with that train freight volume will be increasing.

Liu: It is also not just about the price, but also about habit. If you have been using the ship, you will stick to it. You have your contacts, where is your motivation to change? If you alter your transport routes, you have many new challenges. But with the development of the rail routes and the increased talk about it, we see more and more people willing to test new grounds and attempt it. Our network helps companies make this step.

What services do you plan to offer?

Liu: We will differentiate between online and offline presence. Offline, we plan to have annual general meetings. Even though nowadays everything is done online, talking face-to-face to partners is still valuable. Our first meeting will be next year, and the agenda will consist of case study presentations, as well as intense one-on-one meetings. Apart from that we will have an online marketing platform. Companies get a profile on our platform, where they can promote themselves, post news and information and get into contact with others.

Hellmers: Additionally, we want to have a knowledge area with news about the BRI. And we plan to have a payment protection service. Companies who are collaborating with foreign companies for the first time will have a guarantee that payments are secured.

Bremen is a logistics hub, yet no Silk Road trains are stopping here, in comparison to Hamburg. For which Bremen based companies is the network suitable?

Liu: Bremen is historically not as closely connected to Asia as Hamburg or Düsseldorf, which has close ties to Shanghai or Japan. Bremen was always more about the American trade. But there are companies in Bremen which are interesting for us: on the one hand, companies which want to widen their client base in China, that is to say forwarders. The companies that operate in Cargo Distribution Centre GVZ are our clients and would be the ones really benefiting from our services. They are relying on forwarders and German customers to bring business to their companies. With us, they could be directly visible to the Chinese forwarders.

To come to an end, let’s speak about the geopolitical effects of the BRI. Bremen’s ports are vital to our economy. But the BRI changes the flow of goods towards train and towards Mediterranean ports. Will this affect Bremen’s ports negatively?

Hellmers: You need to understand what China is doing. The Chinese government is without a doubt exerting geopolitical influence. This is often perceived negatively. But we are seeing it from a neutral business opportunity point of view. It is not for us to judge what is happening.

The question that has to be asked is: Are we as Germans threatened by that? We might be as a nation – but as a small and medium company? Not so much. The redistribution of supply chain and wealth will always be an opportunity, which is where we come in. This is our chance – the Chinese government is approaching businesses in a very open manner, they bring money and they need partners. It is an opportunity that has to be taken. So how will ports develop? Hard to say, it depends on so many factors, I can’t give a forecast.

Mrs. Liu, Mr. Hellmers – thanks for the interview!

Success Stories

10 Leading Coffee Companies from Bremen

From trading to roasting to logistics – no one does coffee quite like Bremen. But who are the players driving the business in Germany’s coffee capital? Meet ten of them.

Learn moreBremen’s Economy in Figures: Statistics 2025

The State of Bremen is a strong economic hub. A look at the latest statistics highlights its economic strength — summarising key data such as cargo volumes, export performance, industry turnover, and more.

Learn moreMedium-Sized Companies in Bremen Showcasing the Full Range of the Local Economy

Medium-sized companies form the backbone of Bremen’s economy. They create jobs and produce goods that are in demand worldwide. Here is a selection of ten businesses that illustrate the diversity of Bremen’s economic landscape.

Learn more