Built on Solid Ground: What History Can Tell Us about the Property Market in Bremen

Real estateA historical perspective of Bremen's property market

The real estate sector is currently in a crisis. However, if we look back into the past, data from previous decades shows that Bremen's property market has remained stable, despite the challenging times.

When taking this look at the historical real estate market in Bremen, we're concentrating on the commercial market for office space and logistics facilities and also the investment market. The data comes from the property market reports issued annually by Bremeninvest (WFB Wirtschaftsförderung Bremen GmbH).

Office buildings: low vacancy rate and extremely popular

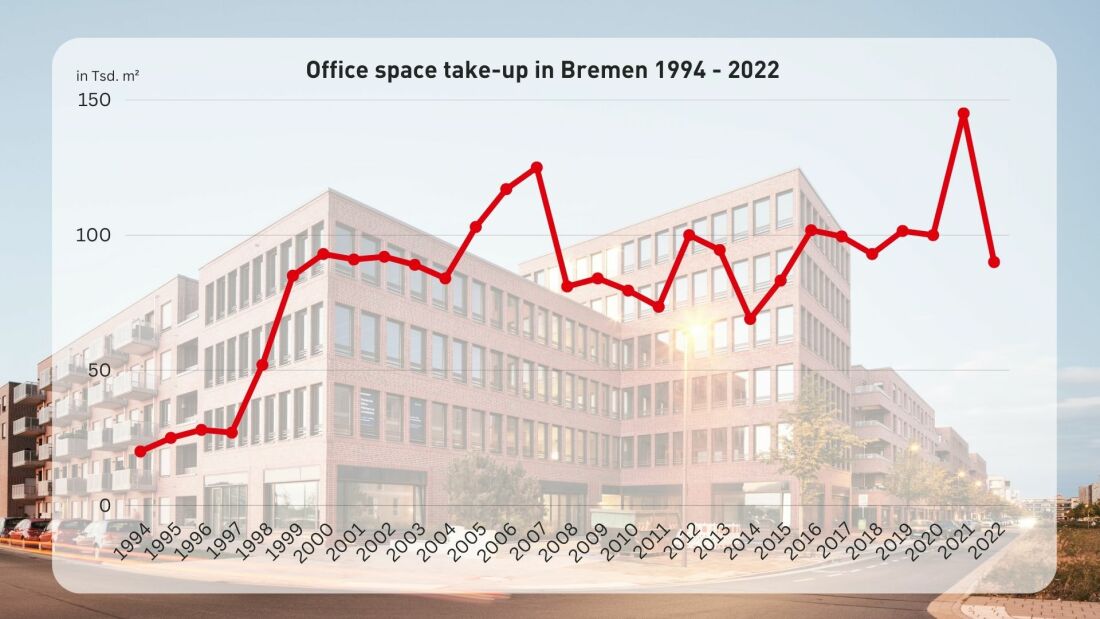

Let´s start with office buildings. From 2.9 million square metres in 1994, the amount of office space has grown steadily to reach its current level of 3.8 million square metres. This amount of space used for offices has increased annually. In recent years, the take-up of office space regularly came near to the 100,000 square metre mark, a figure that was significantly over-topped in the record-breaking year of 2021. Although the crisis years did reduce demand, these reductions have remained at a stable level.

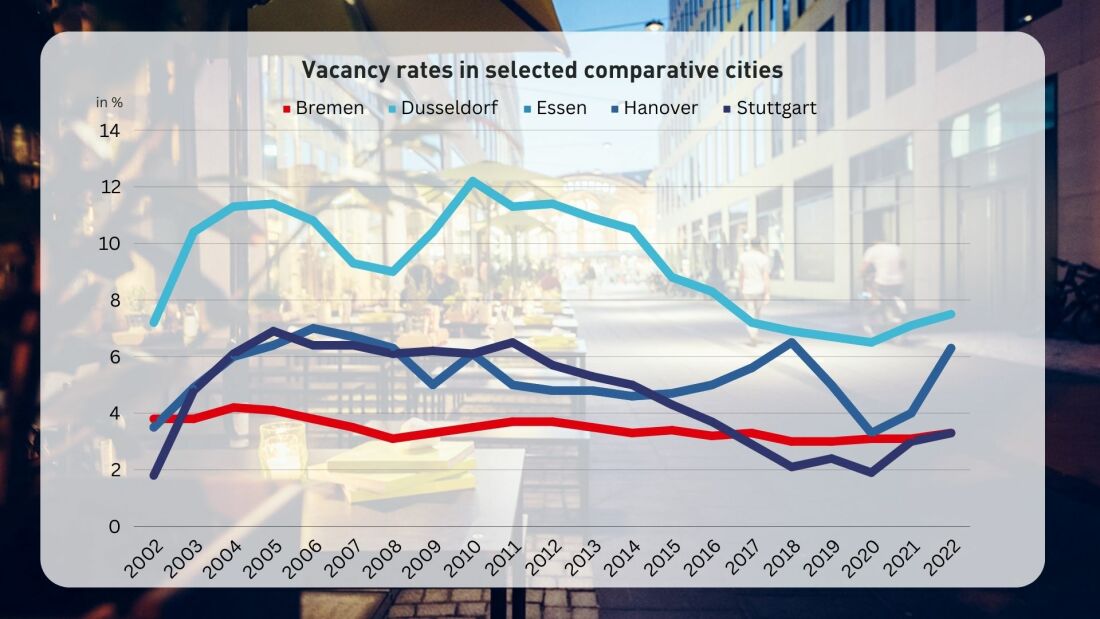

For many investors, it is the vacancy rate that is of particular interest, because this shows how much of the office space is actually occupied and therefore the strength of actual demand in a particular location. From 2002, which is when this data was first collected, the vacancy rate in Bremen has oscillated between 3 and 4 percent, which is low compared to other cities of a similar size.

In times of crisis, such as after 2001 and 2007, and even 2020, the vacancy rate in Bremen did rise, as expected, but by hardly more than one percent. This is clear proof of Bremen's resilience.

Similar tendencies can also be seen in the rental price trend. Over the years, this has moved solidly upwards in a consistent trajectory to peaks of EUR 11.25 in 2003 and EUR 14.80 Euro in 2023. Even the most challenging times have only caused minor fluctuations. In prime locations, rents have reached up to EUR 20 (with a market coverage of between 5 and 10 percent).

This also illustrates that, for companies large or small, Bremen remains an attractive place, either to locate their head office or a subsidiary, despite the crises and changes. Office space is still in great demand and continues to be a decisive factor in the property market, especially in Bremen's New Harbour District (Überseestadt).

Logistics facilities market

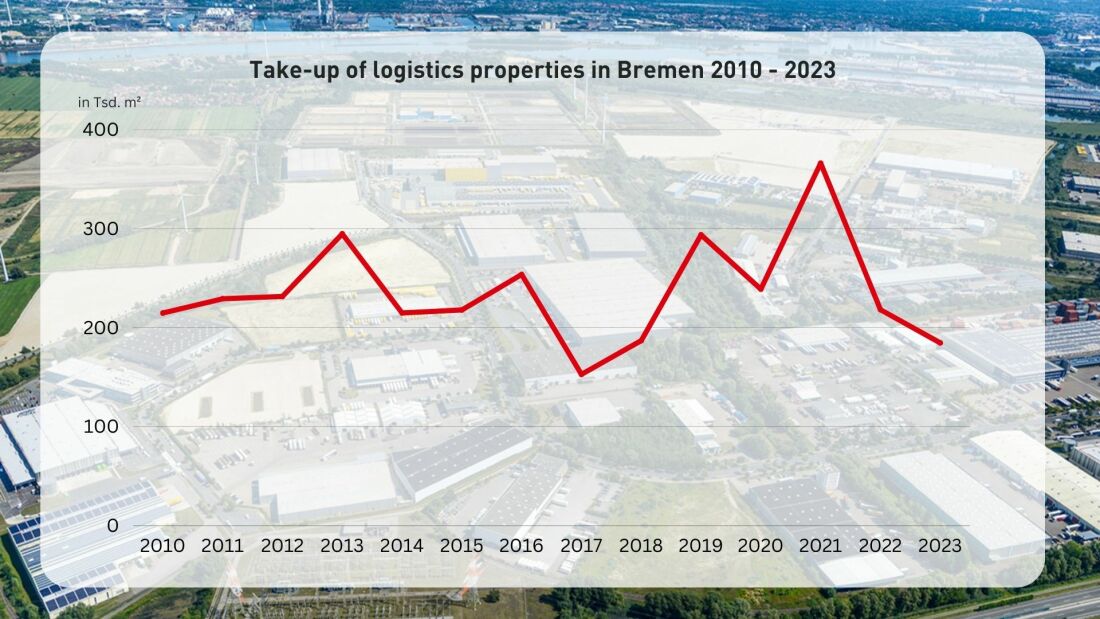

As a centrally located hub, with excellent connections to ports, motorways and the European rail network, logistics has always played a major role in Bremen's economy. And the volume of logistics facilities has increased constantly as a result. In 2020, it reached the three million square metre mark for the first time. Since then, it has increased by a further 10 percent. Over the past decade, this means the sector has grown by around 3.2 percent (CAGR: compound annual growth rate) annually.

Demand continues at a steady level. Every year, an average of 230,000 square metres of logistics premises come into use.

As in the office property sector, the logistics sector is characterised by low vacancy rates. In this sector, vacancy rates in Bremen fluctuate between 1 and 4 percent, with shortages being evident during economic upturns.

Despite a fall in 2023, all the forecasts predict that vacancy rates will remain low in future. Bremen, like many other places in Germany, is running out of usable space and only new approaches such as brown-field developments, more efficient, higher density properties and digitisation will make it possible to meet the growing demand for space in the future.

Investment market

In the past few years, Bremen has become ever more popular as a location for capital investors and has experienced a growth in investment volume.

Over the last decade, there has been a significant increase in the level of interest from international investors in particular. Since then, a high point averaging 150 million Euros a year has been achieved.

However, the graphics also show that the investment sector is extremely vulnerable to crisis. Today's figures are far removed from the historic peaks of years such as 2021, when transactions hit a high of EUR 570 million. Crises and other factors such as high interest rates have left obvious traces in the historical analysis.

However, a closer look at the types of property in demand reveals that: it is office premises and logistics facilities that have attracted the greatest interest from investors in the past 15 years, whereas retail locations have declined in popularity. This directly reflects the long-term trends in the sector, in which online trade competes with retail.

Conclusion

Looking back at the office, logistics and investment sectors in Bremen over the past 20 years, we can see that the property market remains resilient, even in times of crisis. Although the Hanseatic city of Bremen cannot completely shield itself from prevailing market trends, setbacks are minor and demand remains high. It recovers quickly after the crises are over. In the long term, Bremen will therefore able to secure its reputation as an attractive location, both nationally and internationally, and react effectively to the ever-changing market environment.

Success Stories

Bremen’s Economy in Figures: Statistics 2025

The State of Bremen is a strong economic hub. A look at the latest statistics highlights its economic strength — summarising key data such as cargo volumes, export performance, industry turnover, and more.

Learn moreState of Bremen at Expo Real 2025: impetus for a resilient and liveable city

The state of Bremen will be presenting itself with a strong joint stand at Expo Real in Munich, Europe's leading real estate trade fair, from 6 to 8 October 2025. 25 companies and institutions from Bremen and Bremerhaven will present their current real estate projects and development prospects.

Learn moreMedium-Sized Companies in Bremen Showcasing the Full Range of the Local Economy

Medium-sized companies form the backbone of Bremen’s economy. They create jobs and produce goods that are in demand worldwide. Here is a selection of ten businesses that illustrate the diversity of Bremen’s economic landscape.

Learn more