Key data on the property market in Bremen 2024/2025

Real Estate Market at a Turning Point!

In 2025, the first signs of a stable recovery are emerging across almost all market segments in the Hanseatic city. Bremen serves as a prime example for many medium-sized cities in Germany: the demands on land use are increasing. Consumer behavior is changing. Construction and financing costs are rising. A wide range of challenges, in other words—challenges that Bremen faces with a mix of perseverance, innovative strength, and an urban drive for design.

All data can be found in the annually published Real Estate Market Report. The report is produced by WFB in collaboration with renowned market analysis institutes for the real estate location Bremen.

On this page, you will find the latest figures in the segments of office real estate, logistics real estate, residential real estate, retail locations, and the investment market. The data for 2025 are projections based on figures available at the time of collection.

On the right, we provide the reports from the past two years for download. You can also find all reports on our Downloads/Publications page.

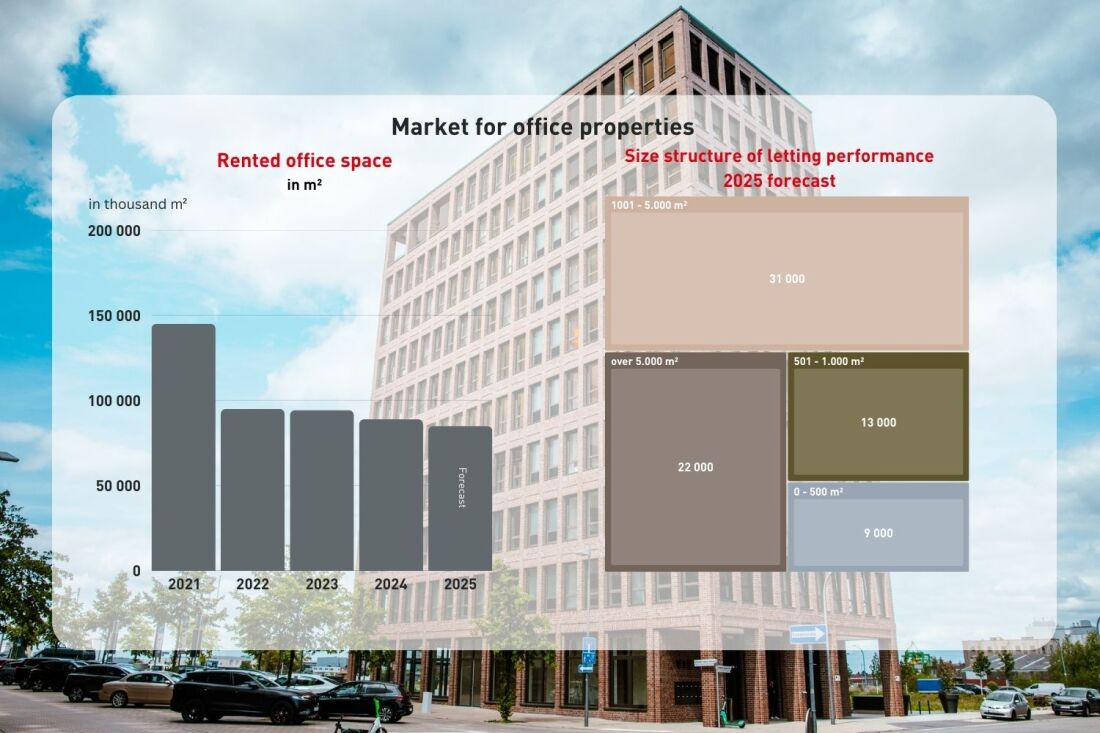

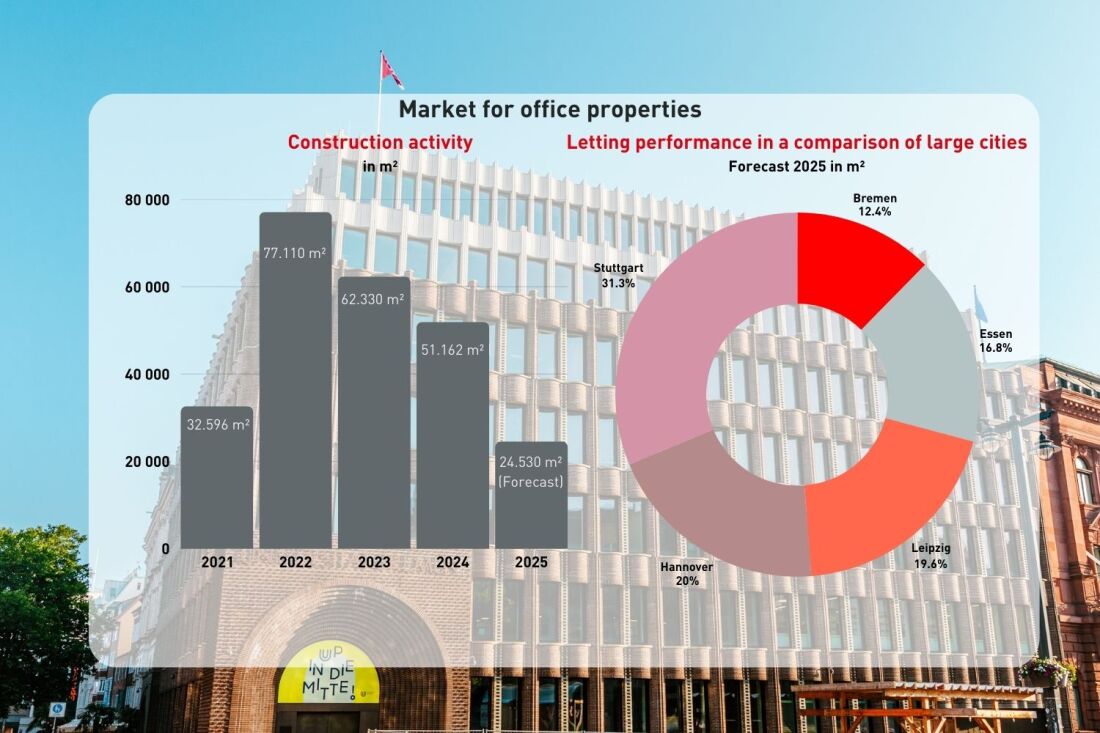

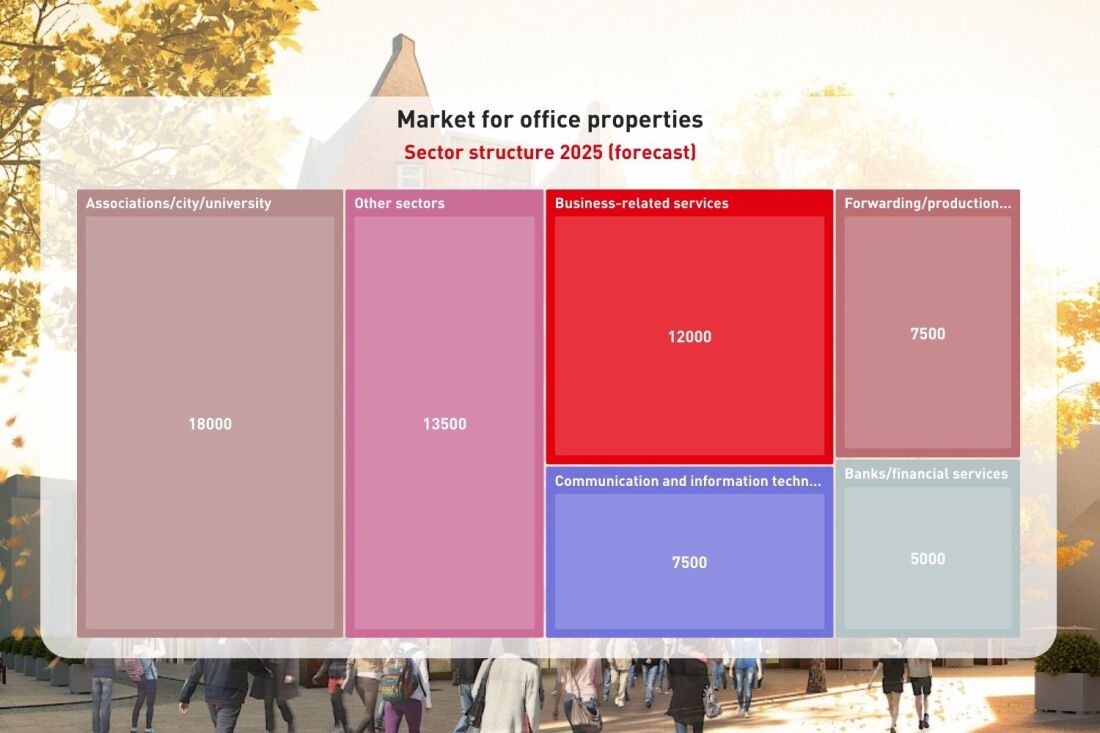

2024/2025: Take-up | Construction Activity | Price Levels

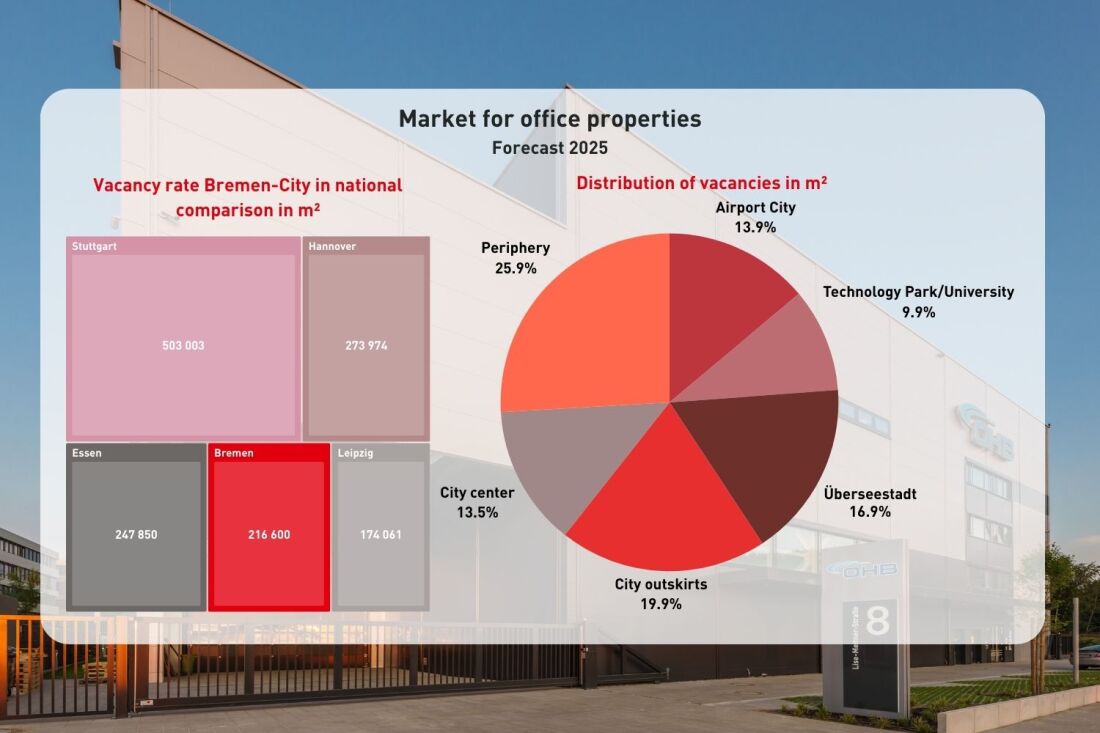

- Vacancy rate increased to 5.6% (2024: 5.4%)

- Leased space 2025: forecast 75,000 m² (2024: 89,000 m²)

- Leased space 2025: around 30,000 m² in the first half of the year

- Construction activity 2024: 52,000 m² (forecast 2024: 25,000 m² of new office space)

- Prime rents around €16.00/m²

Click on the images to open them in full view.

2024/2025: Take-up | Industrial Areas | Price Levels

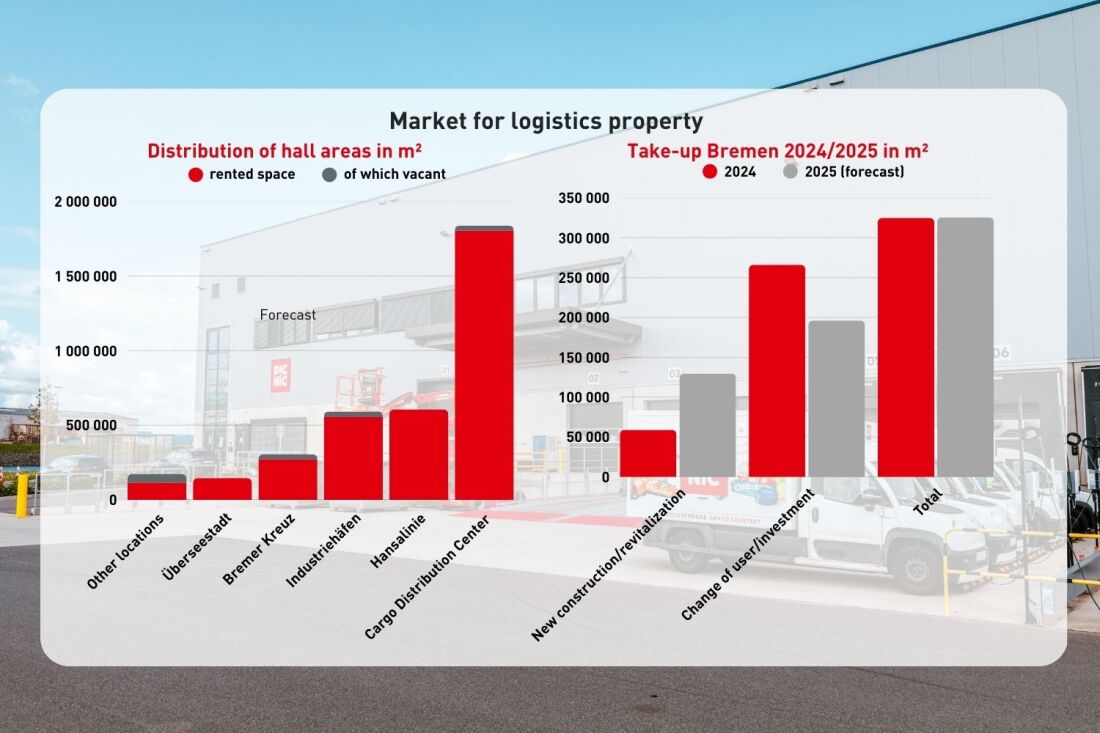

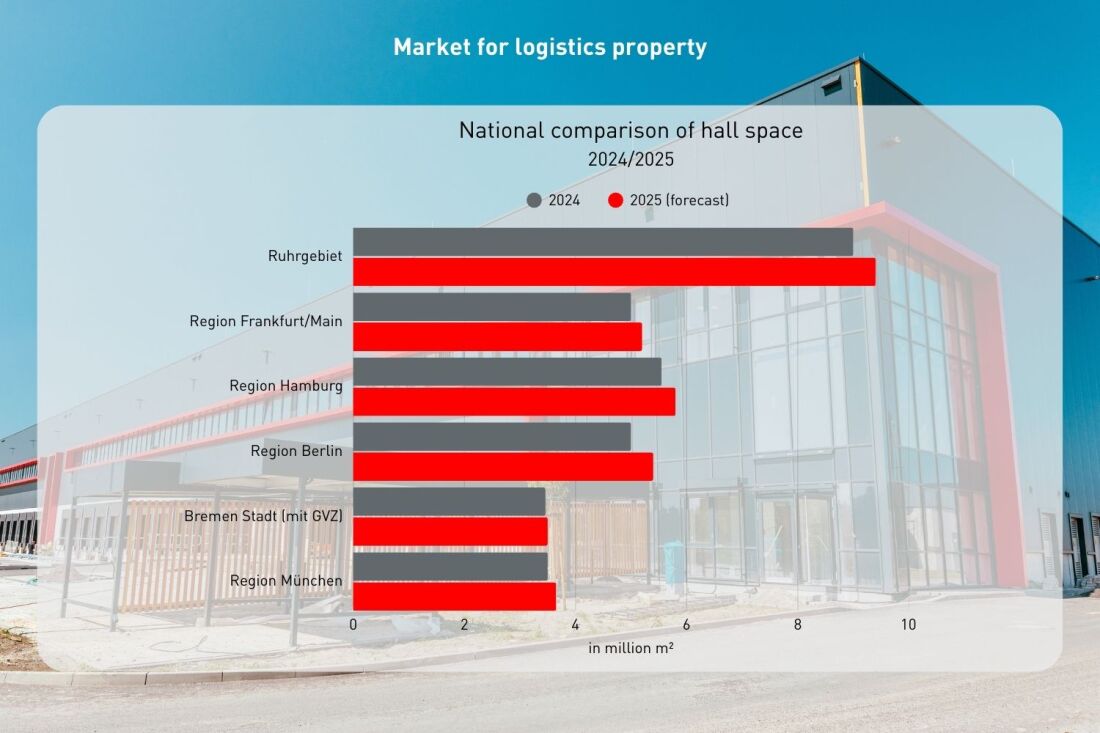

- Stock of logistics hall space slightly increased to over 3.5 million m² (2024: 3.35 million m²)

- Doubling of new-build and revitalization take-up: 129,500 m² (2024: 59,000 m²)

- Total take-up: 325,700 m² (previous year: 324,960 m²)

- Vacancy rate at 4.74% (2024: 5.15%)

- 166,000 m² of available logistics hall space

- Logistics property rents between €3.50 and €6.00/m²

- GVZ Bremen: total logistics hall space of 1.8 million m²

Click on the images to open them in full view.

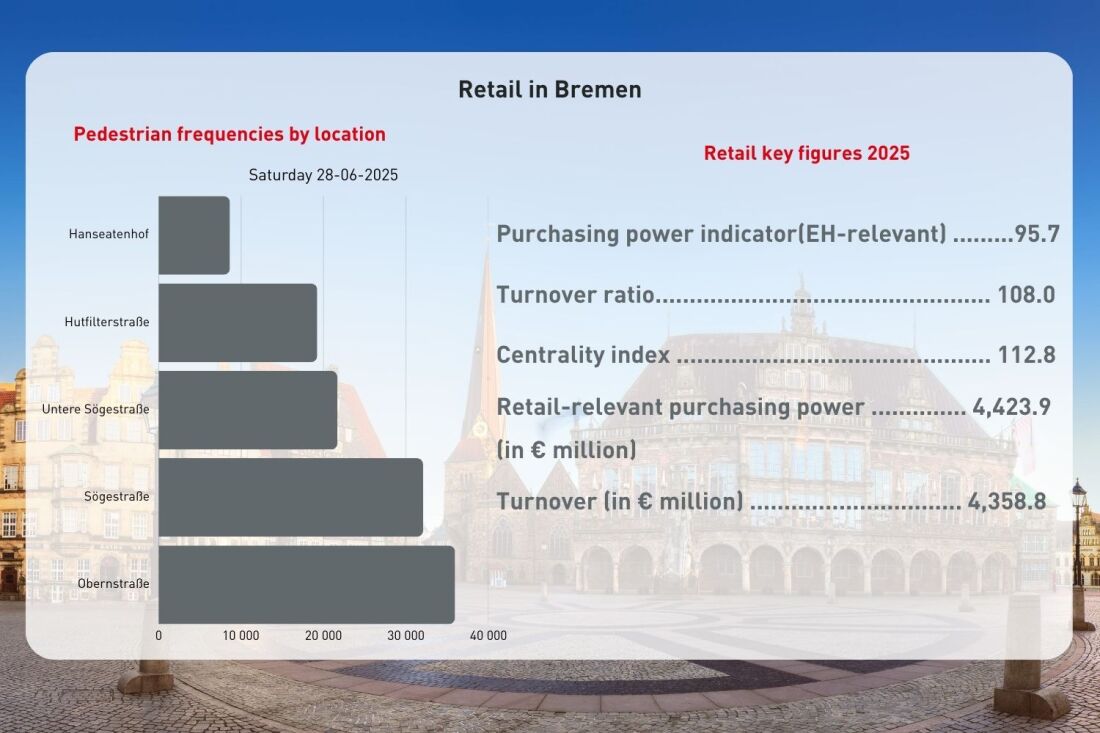

2024/2025: Structure | Locations | Price Levels

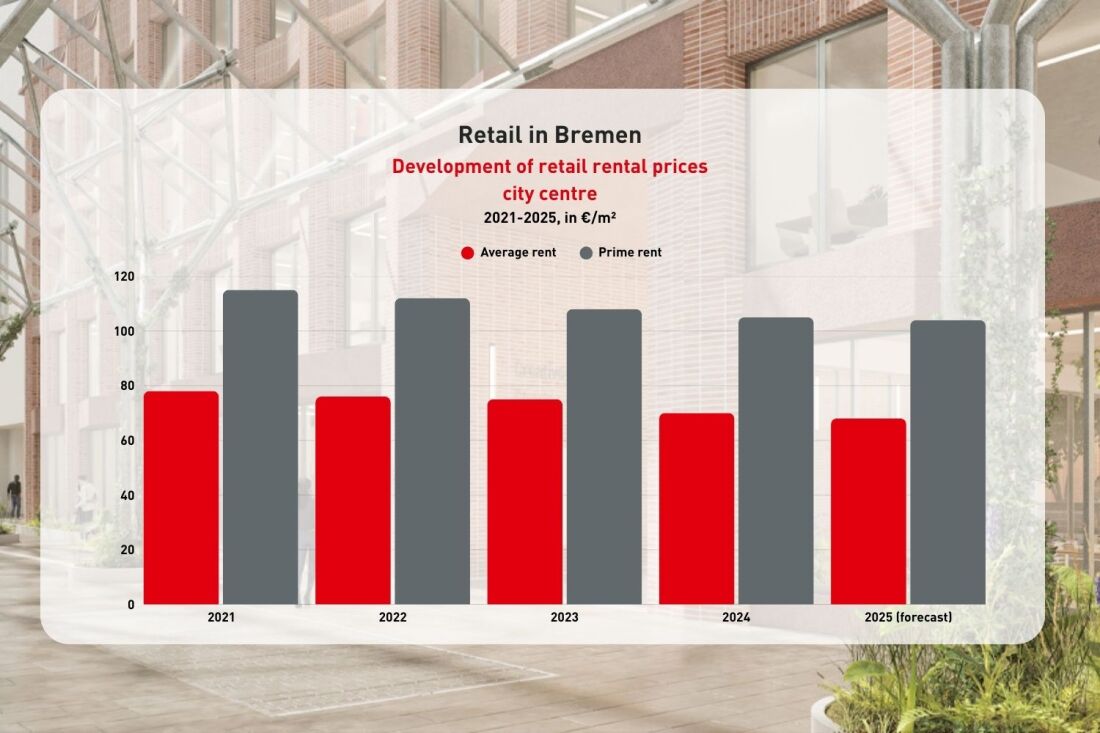

- City center undergoing structural transformation

- Faculty of Law of the University of Bremen moved into the city center with 18,000 m²

- Purchasing power at €4,423.9 million (2024: €4,161 million)

- Turnover at €4,358.8 million (2024: €4,179 million)

- Retail rents: prime inner-city level at €103.50/m²

Click on the images to open them in full view.

2024/2025: Population Development | Price Levels | Forecasts

- Around 1,000 residential units are being built in the Hulsberg district, with the first already occupied in 2023

- 135 residential units to be completed in the Kaffeequartier

- Purchase prices stagnating, rents continuing to rise

- Average rent level for new-build apartments €13.40/m² (previous year €12.80/m²)

- Average purchase prices at €4,605/m² (2024: €4,562/m²)

Click on the images to open them in full view.

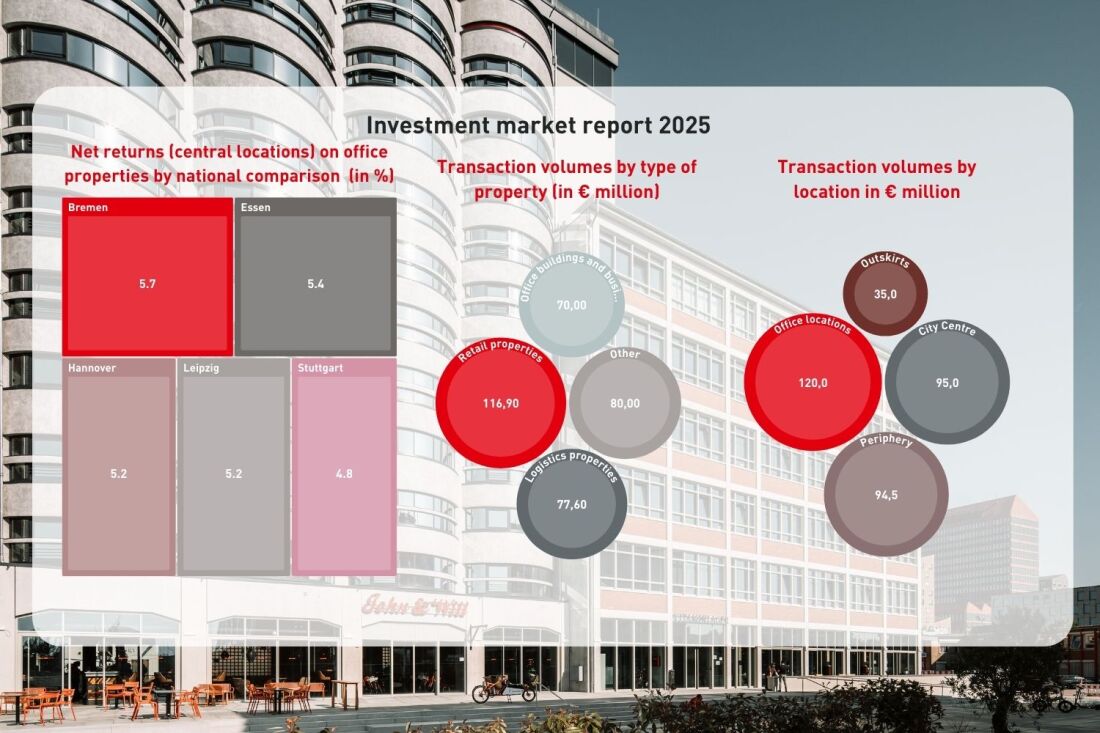

2024/2025: Transactions | Yields | Price Levels

- Transaction volume in 2024: €308.1 million

- Volume first half of 2023: €153.5 million

- Bremen’s investment market is recovering

- Office properties in higher demand

- Transactions becoming smaller: trend toward deals under €10 million is solidifying

Click on the images to open them in full view.